Non-Dairy Butter Market to Experience Unstoppable Growth at a CAGR of 13.9% | Towards FnB

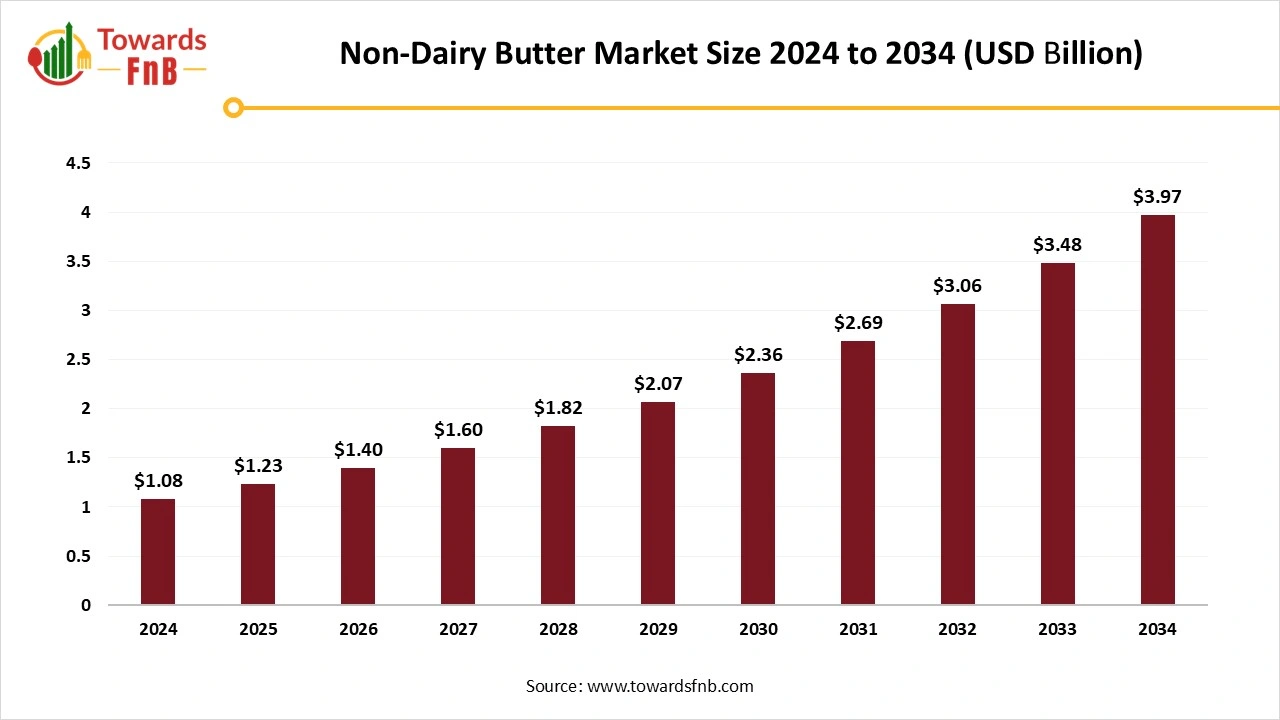

According to Towards FnB, the global non-dairy butter market size is evaluated at USD 1.23 billion in 2025 and is anticipated to surge USD 3.97 billion by 2034, reflecting at an impressive CAGR of 13.9% from 2025 to 2034. This growth is fueled by the rising demand for plant-based, health-conscious, and sustainable food options as consumers increasingly seek alternatives to traditional dairy products.

Ottawa, Dec. 10, 2025 (GLOBE NEWSWIRE) -- The global non-dairy butter market size stood at USD 1.08 billion in 2024 and is predicted to increase from USD 1.23 billion in 2025 to reach around USD 3.97 billion by 2034, according to a report published by Towards FnB, a sister firm of Precedence Research. This growth is supported by the expanding adoption of vegan, lactose-free, and flexitarian diets, along with increased awareness of the health benefits of plant-based fats over animal-based ones.

The primary drivers behind this market’s expansion are the growing demand for healthier alternatives to dairy butter, the rise in lactose intolerance, and the shift towards plant-based diets. Non-dairy butter’s appeal lies in its ability to offer similar taste and texture to traditional butter while being more aligned with consumers' ethical and health preferences.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5943

Key Highlights of the Non-Dairy Butter Market

- By region, North America led the non-dairy butter market in 2024, whereas the Asia Pacific is expected to grow in the foreseeable period.

- By source, the soy segment captured the maximum share in 2024, whereas the peanut butter segment is expected to grow in the foreseeable period.

- By distribution channel, the B2C segment led the non-dairy butter market in 2024, whereas the online segment is expected to grow in the foreseeable period.

A Growing Health-Conscious Population is helpful for the Growth of the Non-Dairy Butter Industry

The non-dairy butter market is expected to grow significantly due to factors including a growing health-conscious population, rising cases of lactose intolerance, and rising demand for dairy-free options. The availability of dairy-free and healthy substitutes on various platforms is one of the major factors driving market growth. These substitutes are equally healthy, nutritious, and flavorful, and hence are highly preferred by the health-conscious population. The market has a large consumer base across different age groups.

The market comprises different dairy-free butter options made from ingredients such as coconut, avocado, and olive oil to replace conventional butter. They are equally flavorful and nutrient-dense, driving market growth. The rising population of health-conscious consumers, the higher demand for plant-based options, and the increasing prevalence of lactose intolerance are other major factors driving market growth.

Technological Innovations Fueling the Growth of the Non-Dairy Butter Market

- Advanced Fat Structuring- The procedure uses oleogels and interesterification to create solid fats from liquid oils. It helps to replicate dairy’s fat structure, which is helpful for better baking and cooking.

- Fermentation and Culturing- Fermenting plant-based bases to achieve a rich, tangy flavor and aroma helps mimic the taste and texture of traditional butter.

- Novel Oil Blends and Extraction- The procedure involves an ideal blend of oils and cold-pressed extraction methods to get that perfect taste and texture of dairy-free products similar to the conventional products.

- Clean-Label and Natural Ingredients- The procedure involves formulations free of soy, palm oil, and artificial additives, including organic ingredients.

Impact of AI on the Non-Dairy Butter Market

Artificial intelligence (AI) is influencing the non-dairy butter market through more precise ingredient selection, tighter production control, and better alignment with consumer expectations for clean-label and plant-based products. In the formulation stage, companies use AI systems that evaluate how specific plant oils and emulsifiers behave under mixing, heating, and cooling conditions. These models examine fatty acid structure, oxidative stability, and melt curves for oils such as coconut, avocado, canola, sunflower, and shea. The output helps developers choose blends that spread smoothly at refrigeration temperatures and perform reliably in baking and sautéing. AI also supports the design of allergen-sensitive formulations by comparing interactions between oil systems and plant-based stabilizers that do not rely on soy or nuts.

Processing operations now incorporate AI-driven monitoring tools. Sensors measure viscosity, moisture, and crystallization patterns during churning and cooling. Machine learning models respond by adjusting agitation speed or cooling rates to prevent issues such as graininess or phase separation. Computer vision systems add another layer of quality control by scanning for color uniformity, surface texture, and packaging defects.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/non-dairy-butter-market

Recent Developments in the Non-Dairy Butter Market

- In May 2025, Maison Linotte, a French luxury pastry brand, launched its plant-based butter. The butter is especially designed for chefs and pastry lovers and is made from organic ingredients, is free from palm oil, additives, and major allergens.

- In March 2025, Savor launched its butter made from carbon. The brand takes carbon dioxide from the air and hydrogen from water to produce the same kinds of fat molecules found in milk, cheese, beef, and vegetable oils.

New Trends of Non-Dairy Butter Market

- The growing number of lactose-intolerant individuals is one of the major reasons for the growth of the market.

- Higher demand for dairy-free and plant-based options for vegans and flexitarians is another major factor for the growth of the non-dairy butter market.

- Higher demand for healthier alternatives with no difference in taste and texture also helps to fuel the growth of the market.

Top Products in the Non-Dairy Butter Market

| Product Category | Description or Function | Common Ingredients or Variants | Key Applications or Consumer Segments | Representative Producers or Brands |

| Plant-Based Butter Spreads | Mainstream dairy-free spreads are formulated for everyday use. | Soy oil blends, canola oil blends, palm oil blends, coconut oil blends | Home cooking, spreading, baking | Earth Balance Original, Country Crock Plant Butter |

| Cashew Butter | Nut-based butter made from roasted or raw cashews, offering a creamy profile. | Smooth cashew butter, roasted cashew butter | Vegan milks, desserts, spreads | Artisana Organics, Kei Nut Cashew Butter |

| Almond Butter | High-protein nut butter with clean-label appeal. | Raw almond butter, roasted almond butter, flavored almond butter | Protein snacks, smoothies, bakery | Justin’s Almond Butter, Barney Butter |

| Peanut Butter (Non-Dairy) | Technically dairy-free, widely used as a non-dairy spread. | Smooth peanut butter, crunchy peanut butter, natural peanut butter | Sports nutrition, school snacks | Skippy, Jif, Peter Pan, and natural peanut butter brands |

| Coconut Butter and Coconut Manna | Butter alternative made from pure coconut flesh. | Raw coconut butter, coconut manna | Vegan desserts, baking, Asian cuisine | Nutiva Coconut Manna |

| Avocado Butter | Plant-based butter made primarily from avocado oil or mashed avocado. | Avocado oil butter spreads, whipped avocado butter | Healthy spreads, premium plant-based consumers | AvoButter brands, private label avocado spreads |

| Sunflower Seed Butter | Allergy-friendly seed-based spread used as a peanut alternative. | Smooth sunflower butter, unsweetened sunflower butter | School-friendly snacks, allergen-free households | SunButter, Once Again Organics |

| Tahini (Sesame Seed Butter) | Traditional sesame paste functions as a non-dairy butter. | Hulled tahini, roasted tahini, raw tahini | Middle Eastern cuisine, vegan sauces, and dips | Soom Tahini, Mighty Sesame Co |

| Hazelnut Butter | Premium nut butter with rich flavor used in spreads and confectionery. | Pure hazelnut butter, chocolate hazelnut blends | Gourmet spreads, pastries | Nocciolata, specialty nut butter brands |

| Macadamia Nut Butter | High-fat, luxurious nut butter for premium applications. | Raw macadamia butter, roasted macadamia butter | Keto diets, gourmet consumers | Milkadamia Macadamia Butter |

| Pistachio Butter | Premium butter with a distinctive green color and rich taste. | Pistachio paste, sweetened pistachio cream | Gourmet desserts, gelato, pastry | Italian pistachio paste producers, premium nut brands |

| Non-Dairy Butter for Baking | Butter alternatives formulated to replicate the performance of dairy butter in pastry. | Plant oil bakery blocks, palm-free butter blocks | Pastry, laminated dough, industrial baking | Flora Plant Butter Blocks, Upfield Professional |

| Blended Nut and Seed Butters | Composite butters combining multiple non-dairy sources. | Almond cashew blends, sunflower chia blends | Functional spreads, wellness consumers | RX Nut Butter, mixed seed butters |

| Omega Enriched Non-Dairy Butters | Butters fortified with plant-based omega-3 and omega-6 oils. | Flaxseed-enriched butter, chia-enriched butter | Health-conscious consumers | Earth Balance Omega 3 Line |

| Flavored Non-Dairy Butters | Dairy-free butter alternatives with added sweet or savory flavors. | Maple almond butter, chocolate cashew butter, garlic herb seed butter | Snacking, premium spreads | Justin’s flavored lines, artisanal brands |

| Organic Non-Dairy Butters | Plant-based butters from certified organic ingredients. | Organic almond butter, organic sunflower butter | Natural food stores, premium buyers | Artisana Organics, Organic nut butter brands |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5943

Non-Dairy Butter Market Dynamics

What are the Growth Drivers of the Non-Dairy Butter Market?

Higher demand for dairy-free options, healthier alternatives, and those with similar taste and texture to conventional products are major factors driving market growth. The growing population of health-conscious and lactose-intolerant individuals is another major factor driving market growth. Non-dairy butter is low in fat and cholesterol and lactose-free, fueling market growth. Ethical and environmental concerns also help fuel the market's growth. Easy availability of such products is another major factor helpful for the growth of the non-dairy butter industry.

Challenge

Premium and Expensive Options obstructing the Growth of the Market

Ingredients and technological advancements involved in manufacturing non-dairy butter incur additional costs compared to conventional butter. Hence, such issues restrain market growth. Such issues affect the price of the final product, which may restrain price-conscious consumers, leading to market growth. Such issues also affect the brand's profitability, further hindering the growth of the non-dairy butter market.

Opportunity

Product Innovation is helpful for the Growth of the Market

Product innovation in the non-dairy butter market involves manufacturing dairy-free dairy products. Hence, the market focuses on maintaining the taste, texture, and nutritional values of such products similar to conventional dairy products. Technological innovations that help maintain the flavor and texture of non-dairy options similar to conventional options are another major factor driving market growth. It also helps to maintain the shelf life of such products.

Non-Dairy Butter Market Regional Analysis

North America led the non-dairy butter market in 2024, driven by the region's growing population of health-conscious and lactose-intolerant individuals. Higher demand for healthier and plant-based options is another major factor driving market growth. The regional market also shows growth due to the easy availability of healthier alternatives on various platforms at discounted prices. The US has a major contribution to the market's growth due to higher demand for plant-based options, healthier dairy alternatives, and dairy-free options to avoid excess fat and cholesterol.

Asia Pacific is Expected to Grow in the Forecast Period

Asia Pacific is expected to be the fastest-growing region over the forecast period due to higher demand for healthier, dairy-free, and plant-based options among health-conscious consumers. The availability of such options on various platforms at discounted prices is another major factor driving the market’s growth in the foreseeable period. Technological innovations available in the region, which help manufacture such products and extend their shelf life, are another major factor driving the market's growth. India has made a major contribution to the growth of the region's non-dairy butter market due to the high demand for healthier alternatives among a health-conscious population.

Europe is observed to have a Notable Growth in the foreseeable period

Europe is expected to show notable growth in the forecast period due to the region's healthy demographics. The majority of the population is affected by lifestyle-related health issues such as obesity, diabetes, high cholesterol, and other similar health issues. Hence, consumers in the region prefer fat-free and low-cholesterol options, which helps fuel market growth. Germany has made a major contribution to the region's market growth due to high consumer demand for innovative and plant-based options, such as plant-based butter, yoghurt, creamer, and other dairy products.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Trade Analysis for the Non-Dairy Butter Market

Top Exporters (supply hubs)

- Indonesia: Major global exporter of margarine and edible fat preparations with strong palm-based feedstock availability.

- Belgium: Large processing base with strong EU and global distribution of plant-based spreads.

- Netherlands: High-capacity food-ingredient hub exporting both retail spreads and industrial bakery fats.

- Malaysia: Exporter of refined palm fractions and specialty fats that serve as inputs for non-dairy butter.

-

Poland: Significant EU producer of margarines and spreads with substantial intra-EU shipments.

Top Importers (demand centres)

- China: High-volume importer for retail spreads and industrial fat inputs used by food processors.

- France: Strong food manufacturing sector requiring non-dairy bakery fats and consumer spreads.

- Germany: Large industrial and retail demand for plant-based spreads and interesterified fats.

- United States: Imports specialty vegetable fats and retail non-dairy butter products for bakery and packaged foods.

-

Malaysia and Singapore: Regional processors that import refined fractions and spreads for local use and re-export.

Typical Trade Flows and Logistics Patterns

- Southeast Asia → Global markets: Indonesia and Malaysia ship plant-based spreads and refined fractions to Europe, China, the Middle East ,and regional processors.

- EU cluster → Intra-EU and global distribution: Belgium, the Netherlands and Poland export finished spreads and industrial blends.

- Industrial fats are transported in drums or ISO tanks, with quality risks arising from oxidation and moisture ingress. Retail spreads are shipped in consumer packs or bulk tubs for repacking.

Trade Drivers and Structural Factors

- Vegetable-oil feedstock cycles: Palm, soybean and rapeseed crop conditions directly influence non-dairy butter pricing.

- Dietary shifts: Increased adoption of vegan, flexitarian and lactose-free diets strengthens retail spread demand.

- Functional performance requirements: Industrial buyers prioritise fats that mimic the behaviour of dairy butter in lamination, aeration and baking.

- Regulatory landscape: Rules on dairy terminology, nutrient claims and composition standards shape product positioning.

Government Initiatives and Public-Policy Influences

- Palm-oil export policies: Changes in export taxes, quotas or biodiesel mandates in Indonesia and Malaysia affect the global supply of key inputs.

- Labelling rules: EU and national restrictions on dairy terms influence how plant-based butter products are marketed and declared.

- Trade facilitation programs: Supportive export procedures and port infrastructure in Indonesia and Malaysia improve delivery reliability.

Non-Dairy Butter Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 13.9% |

| Market Size in 2025 | USD 1.23 Billion |

| Market Size in 2026 | USD 1.40 Billion |

| Market Size by 2034 | USD 3.97 Billion |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Non-Dairy Butter Market Segmental Analysis

Source Analysis

The soy segment led the non-dairy butter market in 2024, driven by high demand for plant-based, healthier options globally. Soy butter is an ideal source of protein without the unnecessary fats and cholesterol found in conventional butters. It is high in lysine and other amino acids and is healthy for children as well as adults. Hence, the segment is observed to grow in the market. High demand for soy nut butter among people with nut allergies is another major factor driving market growth.

The peanut butter segment is expected to grow over the foreseeable period due to its high nutritional value, making it a highly demanded option among children and adults alike. Peanut butter contains oleic acid and omega-6 fatty acids, making it healthier for people of all ages. Peanut butter is a low-calorie, healthy, and fiber-rich option, an ideal replacement for unhealthy and fried options. Hence, the segment will make a major contribution to market growth in the foreseeable period.

Distribution Channel Analysis

The B2C segment dominated the non-dairy butter market in 2024, driven by the easy availability of plant-based butters across various platforms. Butters are healthy and highly sought after by health-conscious people who wish to avoid excess cholesterol and fat. Growing health consciousness and the rising population of vegans and plant-based diet followers also help fuel the market's growth. Plant-based butters are healthy and have a similar taste and texture to conventional butter.

The online retail segment is expected to grow in the foreseeable future due to the platform's convenience. Such platforms offer a wide variety of options across different categories at discounted rates. Hence, such factors further fuel the market's growth. Online platforms provide detailed information and reviews on all products, helping consumers shop smartly. Hence, the segment makes a major contribution to the region's market growth.

Additional Topics Worth Exploring:

- Dietary Supplements Market: The dietary supplements market size is projected to reach USD 464.58 billion by 2034, growing from USD 192.68 billion in 2025, at a CAGR of 9.2% from 2025 to 2034.

- Frozen Food Market: The global frozen food market size is expected to grow from USD 214.32 billion in 2025 to reach around USD 347.01 billion by 2034, at a CAGR of 5.5% over the forecast period from 2025 to 2034.

- Vegan Food Market: The global vegan food market size is evaluated at USD 22.38 billion in 2025 and is expected to reach USD 55.88 billion by 2034, with a CAGR of 10.7% during the forecast period from 2025 to 2034.

- Sugar-Free Food Market: The global sugar-free food market size is expected to grow from USD 48.14 billion in 2025 to USD 83.2 billion by 2034, growing at a CAGR of 6.27% during the forecast period from 2025 to 2034.

- Food Additives Market: The global food additives market size is rising from USD 128.14 billion in 2025 to USD 214.66 billion by 2034. This projected expansion reflects a CAGR of 5.9% throughout the forecast period from 2025 to 2034.

- Ethnic Food Market: The global ethnic food market size is forecasted to expand from USD 93.47 billion in 2025 to reach around USD 179.21 billion by 2034, growing at a CAGR of 7.5% during the forecast period from 2025 to 2034.

- Meal Kits Market: The global meal kits market size is projected to rise from USD 17.11 billion in 2025 to approximately USD 58.8 billion by 2034, registering a CAGR of 14.7% during the forecast period from 2025 to 2034.

- Baking Ingredients Market: The global baking ingredients market size is projected to grow from USD 18 billion in 2025 to around USD 31.72 billion by 2034, at a CAGR of 6.5% during the forecast period from 2025 to 2034.

- Fresh Produce Market: The global fresh produce market size is projected to grow from USD 3,707 billion in 2025 to approximately USD 5,653 billion by 2034. This anticipated growth represents a CAGR of 4.80% during the forecast period from 2025 to 2034.

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

-

Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

Top Companies in the Non-Dairy Butter Market

- Prosperity Organic Food Inc. (U.S.): A leading U.S.-based company specializing in organic, plant-based food products, Prosperity Organic Food Inc. offers a variety of non-dairy butter options made with high-quality ingredients to meet the rising demand for healthier and sustainable food alternatives.

- Pintola (India): Pintola is a prominent Indian brand known for its range of natural, high-protein, and nutrient-dense plant-based products, including non-dairy butters. The company has gained significant market presence by catering to health-conscious consumers with allergen-free, vegan options.

- Alpino Health Foods (India): Alpino Health Foods is a recognized name in India’s plant-based food sector, offering a wide range of non-dairy butter alternatives. The brand focuses on delivering nutritious, clean-label products with a commitment to quality and taste.

- The Leavitt Corporation (U.S.): Based in the U.S., The Leavitt Corporation is a key player in the food industry, known for its innovative approach to producing non-dairy butters and spreads. The company emphasizes plant-based ingredients and sustainable sourcing to meet consumer demands for healthier food options.

- Vegan Way (UAE): Vegan Way, based in the UAE, is a fast-growing brand that focuses on plant-based, dairy-free alternatives, including non-dairy butter. With a mission to cater to the growing demand for vegan and sustainable food options, Vegan Way is expanding its footprint in the Middle East market.

- Naturli Foods A/S (Denmark): Naturli Foods, a Danish company, is a pioneer in the plant-based food space, offering a diverse range of non-dairy butter products. The company is known for its commitment to sustainable practices and high-quality plant-based ingredients, providing consumers with delicious, cruelty-free alternatives.

Segment Covered in the Report

By Source

- Soy

- Peanut

- Pistachio

- Cashew

- Almond

- Others

By Distribution Channel

- B2B

- B2C

- Supermarkets/Hypermarkets

- Convenience stores

- Grocery Stores

- Online Sales Channels

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5943

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

➡️Coffee Beans Market: https://www.towardsfnb.com/insights/coffee-beans-market

➡️Soybean Market: https://www.towardsfnb.com/insights/soybean-market

➡️Beef Market: https://www.towardsfnb.com/insights/beef-market

➡️Cheese Market: https://www.towardsfnb.com/insights/cheese-market

➡️Food Packaging Market: https://www.towardsfnb.com/insights/food-packaging-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.